today’s complex business landscape, advisory services have become essential for organizations aiming to make informed strategic decisions, optimize operations, and enhance overall performance. Yet, one of the most pressing questions for both businesses and advisory firms is: how do you measure the return on investment (ROI) of these services? Unlike traditional products or marketing campaigns, advisory services often deliver value in both tangible and intangible ways. This article explores how organizations can accurately evaluate the ROI of advisory services, ensuring informed decision-making, accountability, and strategic alignment.

Measuring the ROI of Advisory Services

In today’s complex business landscape, advisory services have become essential for organizations aiming to make informed strategic decisions, optimize operations, and enhance overall performance. Yet, one of the most pressing questions for both businesses and advisory firms is: how do you measure the return on investment (ROI) of these services? Unlike traditional products or marketing campaigns, advisory services often deliver value in both tangible and intangible ways. This article explores how organizations can accurately evaluate the ROI of advisory services, ensuring informed decision-making, accountability, and strategic alignment.

Why Measuring ROI Matters for Advisory Engagements

Organizations invest significant resources in advisory services, whether for strategy consulting, HR optimization, operational improvements, or risk management. Measuring ROI is crucial for several reasons:

- Accountability: Companies need to ensure that the fees paid for advisory services translate into meaningful results.

- Informed Decision-Making: Clear ROI metrics help leaders evaluate whether to continue, scale, or adjust advisory engagements.

- Vendor Selection: Understanding ROI helps organizations select advisory firms that deliver measurable impact.

- Strategic Planning: Data-driven insights about ROI inform resource allocation and long-term planning.

For advisory firms, demonstrating measurable ROI is equally important to build credibility, strengthen client relationships, and differentiate their services in a competitive market.

Challenges in Measuring Advisory ROI

Despite its importance, measuring ROI in advisory services comes with unique challenges:

- Attribution: Determining which business outcomes result from advisory interventions versus external factors.

- Time Lag: Advisory impact may unfold over months or years, making immediate measurement difficult.

- Qualitative Outcomes: Many benefits, such as improved leadership effectiveness or decision-making quality, are hard to quantify.

- Complex Metrics: Different engagements require different metrics, adding complexity to standardization.

Recognizing these challenges is the first step toward designing a robust ROI measurement strategy.

Frameworks for Measuring ROI of Advisory Services

A structured framework is essential for capturing the full value of advisory services. Several approaches can be adapted to suit organizational needs.

Traditional ROI Formula and Its Limitations

The traditional ROI formula is useful for straightforward financial assessments but falls short in advisory contexts. For example, a cost-saving initiative implemented after consulting may be partially attributable to the advisor, but also influenced by internal changes. This limitation necessitates a more nuanced approach.

Balanced Scorecard for Advisory Services

The balanced scorecard approach evaluates advisory ROI across multiple dimensions:

- Financial Metrics: Revenue growth, cost reductions, profit margins.

- Customer Metrics: Client satisfaction, retention, loyalty.

- Internal Processes: Efficiency, compliance, innovation.

- Learning and Growth: Staff skill development, leadership capability.

By integrating these perspectives, organizations gain a holistic view of advisory impact.

Outcome-Based Measurement Framework

Outcome-based frameworks focus on results rather than activities. They link advisory input to strategic goals such as risk reduction, market expansion, operational improvements, or customer experience enhancement. Outcome-based frameworks allow leaders to see the direct connection between consulting actions and business outcomes.

Key Quantitative Metrics to Measure ROI

Quantitative metrics provide hard evidence of value delivered. Some of the most impactful metrics include:

- Revenue Growth: Assessing incremental revenue directly linked to advisory strategies.

- Cost Savings: Measuring reductions in operational expenses or improved resource utilization.

- Efficiency Gains: Evaluating process improvements and productivity gains.

- Time-to-Value: Tracking how quickly advisory insights translate into measurable benefits.

Risk Mitigation: Estimating the financial impact of avoided risks and compliance failures.

Key Qualitative Metrics to Measure ROI

Not all value is financial. Qualitative metrics are equally important:

- Improved Decision-Making: How advisory input enhances strategic choices.

- Leadership Confidence: The influence on leaders’ ability to make informed decisions.

- Innovation Enablement: Advisory guidance that sparks new products, services, or processes.

- Stakeholder Satisfaction: Feedback from internal and external stakeholders.

- Cultural and Organizational Change: Shifts toward higher performance, adaptability, or collaboration.

While these benefits are harder to quantify, they often lead to measurable long-term value.

Using Benchmarking and Comparisons for ROI Evaluation

Benchmarking involves comparing results against:

- Industry standards

- Historical performance

- Peer organizations

This contextualizes advisory impact, highlighting areas of relative strength or weakness. For instance, a cost reduction of 5% may be substantial in one sector but below average in another. Benchmarking ensures ROI is meaningful rather than abstract.

Key Qualitative Metrics to Measure ROI

Not all value is financial. Qualitative metrics are equally important:

- Improved Decision-Making: How advisory input enhances strategic choices.

- Leadership Confidence: The influence on leaders’ ability to make informed decisions.

- Innovation Enablement: Advisory guidance that sparks new products, services, or processes.

- Stakeholder Satisfaction: Feedback from internal and external stakeholders.

- Cultural and Organizational Change: Shifts toward higher performance, adaptability, or collaboration.

While these benefits are harder to quantify, they often lead to measurable long-term value.

Using Benchmarking and Comparisons for ROI Evaluation

Benchmarking involves comparing results against:

- Industry standards

- Historical performance

- Peer organizations

This contextualizes advisory impact, highlighting areas of relative strength or weakness. For instance, a cost reduction of 5% may be substantial in one sector but below average in another. Benchmarking ensures ROI is meaningful rather than abstract.

Steps to Build an ROI Measurement Plan for Advisory Projects

- Align Objectives: Clearly define the business outcomes advisory services aim to achieve.

- Select Metrics: Identify both quantitative and qualitative metrics.

- Establish Baselines: Capture current performance levels before the advisory engagement.

- Collect Data: Implement systems to track relevant data throughout the project.

- Analyze Impact: Compare outcomes to baselines and benchmarks, adjusting for external factors.

- Communicate Results: Present ROI insights clearly to stakeholders, emphasizing strategic impact.

Tools and Techniques for Tracking ROI

Modern tools simplify ROI tracking:

- Dashboards and Analytics Platforms: Visualize data trends and compare KPIs.

- CRM and ERP Systems: Integrate advisory insights with operational and financial data.

- Financial Modeling: Project potential gains and simulate outcomes of different recommendations.

Survey and Feedback Tools: Capture qualitative impact from leaders, employees, and stakeholders.

![]()

Common Mistakes to Avoid When Measuring Advisory ROI

Organizations often fall into pitfalls such as:

- Using inappropriate metrics that do not reflect actual business outcomes.

- Ignoring qualitative benefits that indirectly contribute to value.

- Failing to set baseline measures, making it hard to assess true impact.

- Attributing success solely to advisory input without considering external factors.

Avoiding these mistakes ensures ROI analysis is credible and actionable.

Best Practices for Communicating ROI Results to Stakeholders

Communicating ROI effectively is as important as measuring it:

- Tell a Story: Use data to narrate how advisory actions led to tangible outcomes.

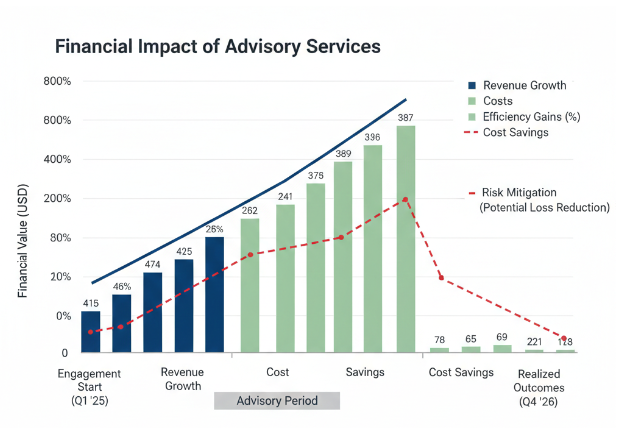

- Visualize Metrics: Charts and infographics make complex results easy to understand.

- Benchmark Context: Compare results to expectations, industry standards, and historical performance.

- Link to Strategy: Emphasize how advisory engagement contributes to overarching business goals.

Frequently Asked Questions About Measuring the ROI of Advisory Services

How soon can ROI be measured after advisory engagement?

Results may appear immediately for cost-saving initiatives, but strategic outcomes often take months or years.

Can qualitative benefits count as ROI?

Yes. Qualitative outcomes like improved leadership or innovation capability contribute to long-term financial and operational performance.

Should ROI be measured for short-term projects?

Even short-term engagements benefit from ROI measurement, though the metrics may be simpler and more immediate.

How do you handle external factors when measuring ROI?

Use comparative benchmarks, control groups, and expert judgment to isolate advisory impact from other influences.

Is ROI the only way to measure success of advisory services?

No. Complementary measures like client satisfaction, adoption of recommendations, and organizational learning enhance understanding.

Conclusion Turning Advisory Insights Into Business Value

Measuring the ROI of advisory services is critical for demonstrating value, informing decisions, and aligning investments with strategic objectives. By combining quantitative metrics, qualitative outcomes, frameworks, bench marking, and real-world examples, organizations can create a holistic picture of advisory impact. Implementing a structured ROI measurement plan not only validates advisory investment but also strengthens organizational learning, leadership effectiveness, and long-term growth. Advisory services are most effective when their value is clearly understood, communicated, and continuously optimized.