Starting a new business is exciting, but it is also full of uncertainty. One of the biggest challenges early-stage founders face is deciding how to fund their startup. Money is not just fuel for operations; it shapes how fast you grow, how much control you keep, and what kind of future your company will have. Choosing the wrong funding strategy can slow you down or even force you to shut down before you reach your potential. Choosing the right one can help you build a strong, sustainable business.

Early-stage funding is not only about getting money. It is about understanding your goals, your market, and the kind of company you want to build. Some startups grow slowly and profitably using their own revenue, while others need outside investment to scale quickly. There is no single best funding strategy for every startup. What matters is alignment between your business model, growth plan, and funding choice.

This guide explains funding strategies for early-stage startups in clear and simple language. It covers all major funding options, how they work, when to use them, and what trade-offs they bring. By the end, you will have a clear framework to choose the funding path that supports your long-term vision.

Understanding Early-Stage Startup Funding

Early-stage startup funding refers to the capital raised during the earliest phases of a business, usually before the company is stable or profitable. This stage includes the idea phase, pre-seed stage, seed stage, and sometimes the early traction phase. At this point, the startup is still testing its product, market, and business model.

Funding at this stage is used to validate ideas, build early versions of the product, attract initial users or customers, and assemble a small team. Revenue is often limited or non-existent, which makes funding decisions more risky. Investors and founders rely heavily on assumptions, early signals, and future potential rather than proven results.

Because uncertainty is high, early-stage funding decisions have long-lasting effects. The investors you choose, the amount you raise, and the terms you accept can shape ownership, decision-making power, and growth pressure for years to come.

Why Matching Funding Strategy With Growth Strategy Matters

Not all startups aim to grow in the same way. Some founders want steady growth, early profitability, and full control over decisions. Others want rapid scaling, global reach, and are willing to trade ownership for speed. Your funding strategy must match your growth strategy, or problems will appear quickly.

If you raise venture capital but your business grows slowly, investors may push you toward decisions that do not fit your market. If you try to bootstrap a business that requires heavy upfront investment, you may run out of time or money before reaching traction. Funding is not neutral. It comes with expectations, timelines, and pressure.

Understanding how fast you want to grow, how much capital your model requires, and how much control you are willing to share is essential before choosing any funding path.

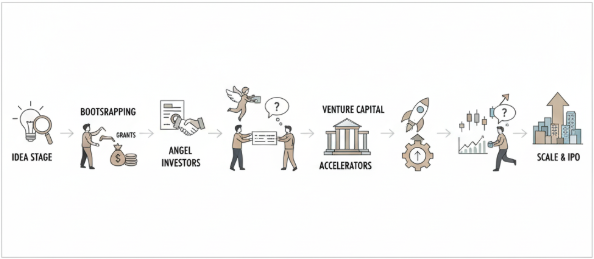

The Startup Funding Lifecycle From Idea to Scale

Most startups follow a rough funding lifecycle, although the exact path differs for each company. In the idea stage, founders often rely on personal savings or small contributions from friends and family. This money is used to research the market, build a basic prototype, or test assumptions.

As the startup moves into validation, seed funding becomes more common. At this stage, founders may raise money from angel investors, accelerators, or early-stage funds. The focus is on proving that customers want the product and that the business can grow.

If the startup shows strong traction and a scalable model, it may later raise venture capital to expand aggressively. Each stage brings different expectations, risks, and levels of scrutiny. Understanding where you are in this lifecycle helps you choose funding that fits your current reality.

Bootstrapping Building With Your Own Resources

Bootstrapping means building a startup using personal savings, early revenue, or internal cash flow instead of external investors. Many successful businesses start this way. Bootstrapping forces founders to be disciplined, customer-focused, and efficient.

One major advantage of bootstrapping is control. Founders keep full ownership and make decisions without investor pressure. This approach often leads to sustainable growth and strong unit economics. Bootstrapped companies also learn quickly because survival depends on real customer demand.

However, bootstrapping has limitations. Growth can be slow, and founders carry personal financial risk. Some markets require significant upfront investment that bootstrapping cannot support. For founders who value independence and steady progress, bootstrapping can be a powerful strategy.

Friends and Family Funding The First External Capital

Friends and family funding is often the first external money a startup receives. This funding usually comes from people who trust the founder rather than the business itself. It is commonly used to move from idea to early validation.

This type of funding can be easier to access and more flexible than institutional capital. However, it carries emotional risk. Mixing business with personal relationships can create tension if expectations are unclear or if the startup struggles.

Clear communication, written agreements, and realistic explanations of risk are essential when raising money from friends and family. Treating this funding professionally helps protect relationships and avoids misunderstandings later.

Angel Investors Smart Capital at the Early Stage

Angel investors are individuals who invest their own money in early-stage startups. Many angels are former founders or industry experts who provide not only capital but also advice, connections, and credibility.

Angel funding is well-suited for startups that have validated their idea and need capital to grow further. Angels often invest smaller amounts than venture capital firms and are more patient in the early stages.

Working with the right angel investor can accelerate learning and open doors. However, founders should still be mindful of dilution and alignment. Not all angels bring the same value, and choosing investors who understand your market is critical.

Venture Capital High Growth, High Expectations

Venture capital is designed for startups that aim to scale quickly and dominate large markets. Venture capital firms invest large sums of money in exchange for equity, expecting high returns within a defined time frame.

VC funding allows startups to hire aggressively, expand globally, and invest heavily in growth. In return, investors expect rapid progress, clear metrics, and ambitious goals. This pressure can drive success but can also lead to burnout or forced pivots.

Venture capital is not suitable for every startup. Businesses with smaller markets, slower growth, or profitability-focused models may struggle under VC expectations. Founders should carefully consider whether this path aligns with their vision.

Incubators and Accelerators Structured Support With Capital

Incubators and accelerators provide early-stage startups with funding, mentorship, and structured programs. Accelerators typically run for a fixed period and end with a demo day where startups pitch to investors.

These programs can help founders refine their business model, build networks, and gain credibility. They are especially useful for first-time founders who benefit from guidance and community.

In exchange, accelerators usually take a small equity stake. Founders should evaluate whether the program’s support and network justify the equity given up.

Crowdfunding Funding From the Crowd

Crowdfunding allows startups to raise money from a large number of people, usually through online platforms. Some models offer rewards, while others offer equity or early access to products.

Crowdfunding can validate demand and generate marketing buzz. It allows founders to test their idea with real customers before full-scale production.

However, running a successful crowdfunding campaign requires effort, planning, and trust-building. Fulfillment delays or unmet expectations can damage reputation if not managed carefully.

Grants and Government Programs: Non-Dilutive Capital

Grants and government programs provide funding without taking equity. This makes them attractive for early-stage startups, especially in technology, research, or social impact sectors.

While grants do not dilute ownership, they often come with strict requirements, long application processes, and reporting obligations. Competition can be intense, and approval is not guaranteed.

For startups that qualify, grants can extend runway and reduce reliance on investors.

Non-Dilutive vs Dilutive Funding

Dilutive funding requires giving up equity, while non-dilutive funding does not. Each has advantages and disadvantages. Dilutive funding often brings expertise and networks but reduces ownership. Non-dilutive funding preserves control but may be limited in size and flexibility.

Most startups use a mix of both over time. The key is understanding the cost of capital beyond money, including time, control, and expectations.

How Growth Strategy Shapes the Funding Mix

A startup’s growth strategy directly influences its funding needs. Subscription-based software businesses may raise early funding to scale sales and marketing. Hardware or deep-tech startups may need upfront capital for development. Lifestyle businesses may rely on revenue instead of investors.

Understanding your unit economics, customer acquisition costs, and scalability helps determine how much funding is needed and from where.

Sequencing Capital Across Early Stages

Smart founders think about funding as a sequence, not a single event. Many startups begin with bootstrapping, then raise angel funding, and later seek venture capital once traction is proven. This approach reduces dilution and increases bargaining power.

Raising capital only when needed and aligned with clear milestones helps maintain control and credibility. Each funding round should support a specific goal rather than simply extending survival.

What Investors Look for in Early-Stage Startups

Early-stage investors focus on clarity and potential. They look for founders who understand the problem deeply, know their customers, and can explain why their solution matters. Strong teams, early traction, and large market opportunities also matter.

At this stage, investors know that plans will change. What matters most is execution ability and learning speed.

Preparing for Early-Stage Funding Conversations

Before talking to investors, founders should be clear about their story, numbers, and goals. Preparation builds confidence and prevents rushed decisions. Understanding your metrics, risks, and roadmap makes conversations more productive.

Building a Compelling Funding Pitch

A strong pitch explains the problem, solution, market opportunity, and why your team can win. It focuses on value, not hype. Clear storytelling builds trust and interest.

Managing Runway, Burn Rate, and Cash Flow

Runway is how long your startup can operate with current cash. Burn rate is how fast money is spent. Managing both carefully is critical at the early stage. Poor cash management is a common reason startups fail.

Understanding Dilution and Ownership Impact

Every funding round reduces founder ownership. Understanding dilution helps founders make informed decisions. Sometimes giving up equity is worth it, but it should always support long-term goals.

Common Funding Mistakes Early-Stage Founders Make

Many founders raise money too early, raise too much, or choose investors who are not aligned. Others ignore unit economics or underestimate execution challenges. Learning from these mistakes can save time and stress.

Practical Criteria for Choosing the Right Funding Path

Choosing a funding strategy requires honesty about goals, risk tolerance, and market realities. There is no perfect answer, only informed trade-offs.

Real-World Funding Strategy Examples

Some startups grow successfully with bootstrapping and revenue. Others rely on venture capital to scale rapidly. Both paths can work when aligned with the business model.

Long-Term Implications of Early Funding Decisions

Early funding choices affect culture, flexibility, and exit options. Founders should think beyond immediate needs and consider where they want the company to be in five or ten years.

Frequently Asked Questions About Early-Stage Funding

What is considered early-stage startup funding?

Early-stage funding includes capital raised during the idea, pre-seed, and seed phases when the business is still validating its model and market.

What is the earliest stage of startup funding?

The earliest stage usually involves bootstrapping or small contributions from friends and family to test the idea.

How do startups get funding without revenue?

They rely on strong problem understanding, market potential, early traction signals, and a compelling vision.

Is venture capital right for every startup?

No. Venture capital suits startups aiming for rapid, large-scale growth. Many businesses succeed without it.

How much funding should an early-stage startup raise?

Enough to reach the next clear milestone, not the maximum possible amount.

Conclusion for Choosing Funding That Supports Your Vision

Funding is not the goal of a startup. Building a valuable, sustainable business is. The right funding strategy supports your vision rather than distorting it. By understanding your growth goals, market needs, and personal priorities, you can choose funding that empowers you instead of controlling you.

Early-stage decisions shape the future. Take the time to choose wisely, stay flexible, and remember that money is a tool, not a measure of success.